AED to INR History: A Journey Through Time

Quick Summary

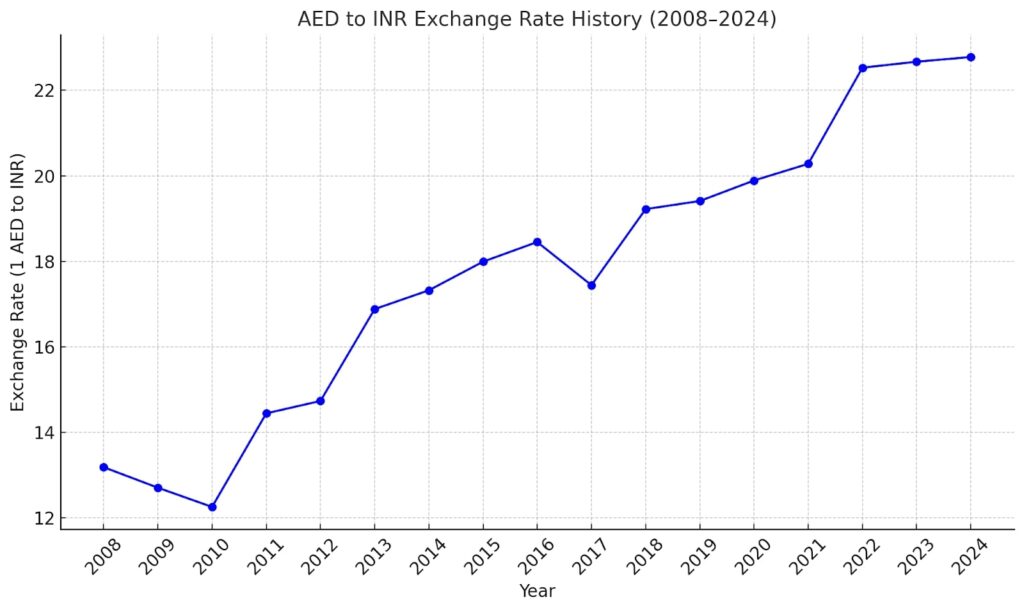

Historical Trends Uncovered: A year-by-year breakdown of how the AED to INR exchange rate evolved from 2008 to 2024, highlighting major economic and geopolitical events behind the shifts.

What Moves the Rate?: Key factors like oil prices, remittances, trade relations, and economic stability explained in simple terms so readers understand why the rates change.

Why It Matters: Real-world implications for expats, travelers, traders, and businesses — helping readers make smarter money moves based on currency trends.

The exchange rate between the United Arab Emirates Dirham (AED) and the Indian Rupee (INR) has always been more than just numbers for a lot of people. From Indian expats working in Dubai and Abu Dhabi to tourists and forex traders, this currency pair holds real-life implications.

So if you’re trying to make sense of the past rates or wondering where things might go next, here’s a deep dive into the AED to INR historical exchange rate story.

Historical Exchange Rate Overview (2008 to 2024)

Let’s walk through how the AED to INR rate has changed over the years and what drove those changes.

2008 to 2010: Post-recession shocks

The 2008 global financial crisis sent ripples across world economies, and currency markets weren’t spared. Investors moved money to safer currencies like the USD, which weakened INR temporarily. The AED to INR rate rose during this period due to overall market uncertainty and volatility.

2011 to 2014: Back to relative stability

India’s economy gained momentum post-crisis. Reforms were kicking in, investor confidence was up, and INR held ground for the most part. AED to INR remained relatively stable during this window, with minor upward movements.

2015 to 2019: Domestic policy changes, global pressures

Demonetization, GST rollout, and the general global slowdown made this period interesting. The INR saw depreciation through much of it. Even though reforms were designed for long-term benefits, they added short-term instability. The AED gradually gained against INR during these years.

2020 to 2021: Pandemic volatility

COVID-19 changed everything. Borders shut, trade slowed, oil prices crashed, and both the Indian and UAE economies took a hit. Currency exchange rates responded accordingly, with AED gaining slightly as INR weakened due to slower economic activity in India.

2022 to 2024: Recovery with headwinds

The bounce-back from the pandemic wasn’t smooth. Inflation, interest rate hikes, and geopolitical tensions affected global currencies. INR weakened slightly during this period while AED remained relatively strong, thanks in part to rising oil prices and better UAE fiscal stability.

AED to INR Exchange Rate Table (2008 to 2024)

Here’s a quick reference table showing the average AED to INR exchange rate each year:

Year | 1 AED to INR |

2008 | 13.18 |

2009 | 12.70 |

2010 | 12.25 |

2011 | 14.44 |

2012 | 14.73 |

2013 | 16.88 |

2014 | 17.32 |

2015 | 17.99 |

2016 | 18.45 |

2017 | 17.44 |

2018 | 19.22 |

2019 | 19.41 |

2020 | 19.89 |

2021 | 20.28 |

2022 | 22.53 |

2023 | 22.67 |

2024 | 22.78 |

What Drives the AED to INR Rate?

Several real-world factors impact how the AED to INR exchange rate moves. Here are the major ones:

1. Oil Prices

The UAE’s economy is oil-driven. High oil prices mean stronger AED, which can make the AED to INR rate rise. When oil prices drop, AED can soften too, but not always at the same scale.

2. Remittances

India gets billions in remittances from expats working in the UAE. More demand for INR means a stronger rupee, and vice versa. The flow of money between these two countries directly impacts this currency pair.

3. India-UAE Trade Relations

India imports crude oil from the UAE and exports food, textiles, and more. When trade is active and balanced, the currency demand helps stabilize rates. Any trade imbalance, however, can shift the equation.

4. Economic Health of Both Countries

Inflation, GDP growth, interest rates, and even political stability in India and the UAE can impact investor confidence and therefore the strength of each currency.

Why Does This Matter?

If you’re wondering why people care about the AED to INR history, here’s why it matters:

- For expats: You want to send money home when the rate favors you. Even a difference of 50 paise can mean thousands saved or lost over a year.

- For travelers: Knowing how the rate has moved helps with budgeting your trip better.

- For traders or investors: Spotting trends in currency behavior helps you make smarter forex or global investment decisions.

- For businesses: Every rupee counts when you’re making cross-border payments or pricing exports.

Final Thoughts

The AED to INR story is one of two nations with deep financial ties and evolving economies. Looking at history tells us that rates rarely move in straight lines. Global and domestic events, policy shifts, and even emotions in the market can influence the numbers.

If you’re keeping an eye on this pair, history is a helpful compass but not the final map. Stay informed, stay alert, and know when to act.

FAQs: AED to INR Exchange Rate History

The rise is largely due to a combination of INR weakening (thanks to inflation, economic reforms, and global slowdowns) and the AED staying relatively stable, backed by oil revenues and UAE’s fiscal discipline.

The highest average rate was in 2024, where 1 AED equaled ₹22.78.

The UAE dirham is pegged to the US dollar, which provides stability. The Indian rupee, however, is a floating currency influenced by domestic policies, market sentiment, and global economic changes.

Since the UAE is a major oil exporter, higher oil prices strengthen its economy and currency. This often leads to AED appreciating or maintaining strength against the INR.

India receives significant remittances from Indians working in the UAE. More remittances mean higher demand for INR, which can temporarily strengthen the rupee and impact the exchange rate.

While historical trends provide context, exchange rates are influenced by unpredictable global events. Use history as a guide, not a crystal ball.

It depends on your goals. If you’re sending money to India, look for times when the INR is weaker. Watching trends and economic indicators can help time it better.

Factors like inflation, GDP growth, political stability, and interest rate changes in India all influence investor confidence and INR strength — directly affecting this exchange rate.

For businesses, it impacts profit margins on imports/exports. For travelers, it affects trip budgeting. Even small shifts in the rate can make a big difference over time.

You can track live rates through forex platforms, banking apps, or financial websites like XE, OANDA, or your local bank’s currency exchange page.